Table of Content

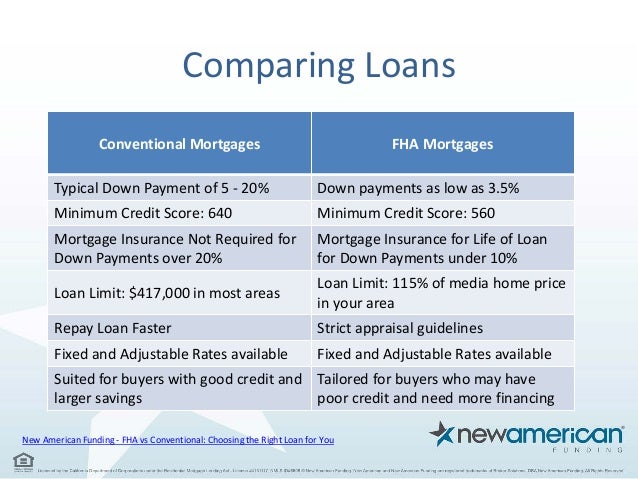

Contact us today to start a conversation about how we can help to navigate the home loan process and land the home of your dreams. Here's a summary of the difference between conventional, FHA, and VA loans, with more details below. Conventional loans have more stringent terms for qualification than VA loans and usually require a down payment. Once you find the one that meets your needs, begin your mortgage application to see how much you qualify for and jumpstart the home buying process.

Conventional loans offer borrowers a surplus of options available in terms of loan period length, interest rates, and maximum loan limits. This flexibility allows you to customize your mortgages to your circumstances and may be preferable to a rigid set of loan guidelines. Moreover, conventional loans apply for all types of property unlike many government-insured loans. One of the biggest benefits of VA loans is the ability to skip the down payment altogether. You can take advantage of the zero percent down option with good credit. But as your home value rises and you pay down your debt, your equity in the property will grow.

Mortgage rates

With VA loans, it’s called an Interest Rate Reduction Refinance Loan . These loans can be used by FHA and VA loan borrowers to reduce their interest rates or change their loan terms to lower their monthly payment. Veterans don’t have to pay mortgage insurance on a VA loan, even with no down payment. The only ‘extra’ fee charged by the VA is the funding fee, which you pay at the closing or can wrap into the loan. The average veteran pays 2.15% of the loan amount for the funding fee. Your debt-to-income ratio measures how much of your monthly gross income goes toward paying off debt.

A conventional loan doesn’t come with any re-payment assurance. Many people, even people with stellar credit, will try and fail to secure a loan from a lender, because of the VA guarantee, underwriting guidelines are more relaxed than traditional loans. Individuals who may not have the financial history to take out a loan make the banks wary. Lenders can select any number of reasons to deny borrowers for a loan. A guarantee goes a long way to assist an individual qualify, and is a hard thing to find in this economy.

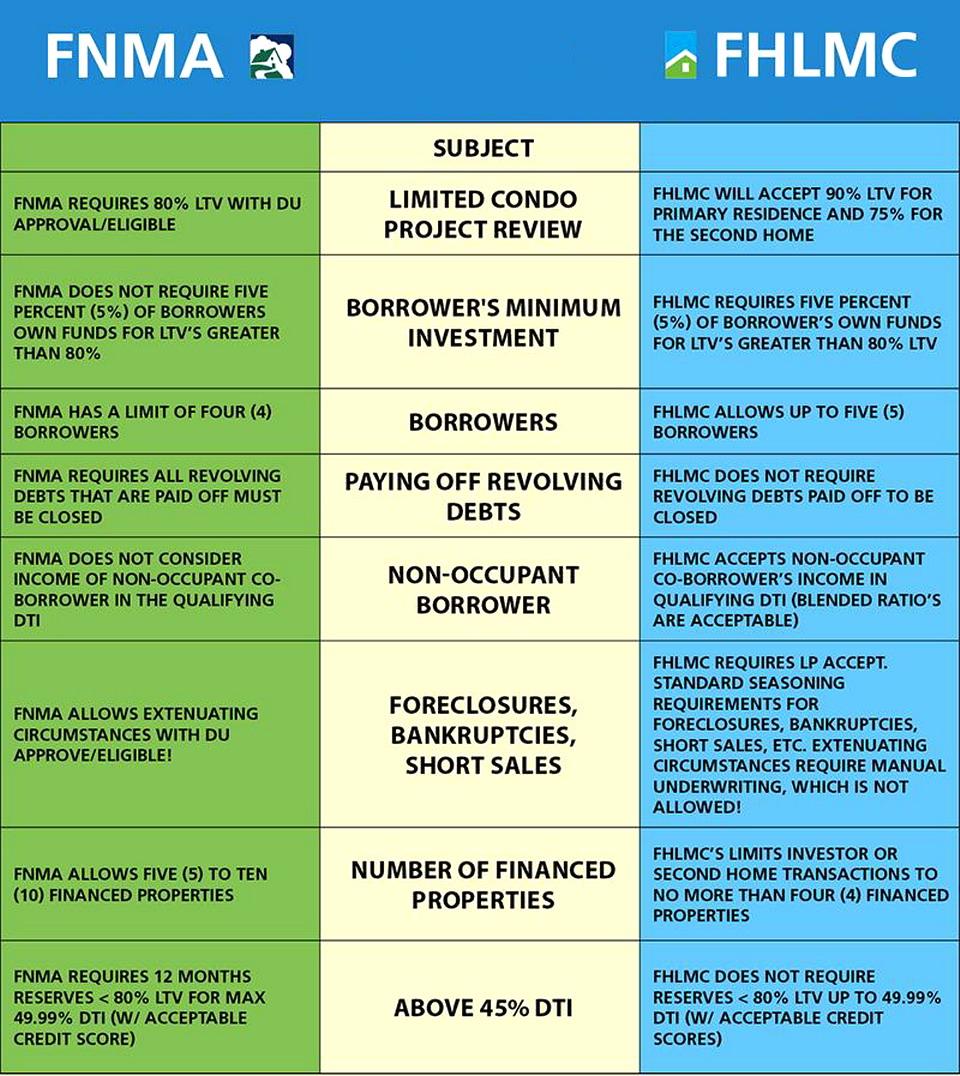

Conventional Conforming Mortgage Loans

Here’s a rundown on how a VA loan versus a conventional loan stack up against each other. Furthermore, you’ll have to borrow less money with a higher down payment, meaning you’ll pay less in interest over the life of the loan. Apply online for expert recommendations with real interest rates and payments. A VA approved lender; Not endorsed or sponsored by the Dept. of Veterans Affairs or any government agency. Customers with questions regarding our loan officers and their licensing may visit the Nationwide Mortgage Licensing System & Directoryfor more information. A .31 percent difference in rate may sound small but can equal tens or even hundreds of thousands in interest savings over the life of the mortgage.

Still, VA loans typically offer better deals for buyers (especially first-time buyers) than conventional loans. So it’s worth working with your real estate agent and the seller’s agent to see if you can get the offer accepted as-is. On the other hand, conventional loans are more flexible and can be used to buy almost any property — including a second home or vacation home.

loanOfficerStep.heading

However, for borrowers who are willing to put down 10% or more, you may be able to find a lender that accepts applicants with scores below 580. Rocket Mortgage® requires FHA borrowers to have a score of at least 580. FHA loans are intended to help people who otherwise might not be able to afford homeownership get into homes. They allow small down payments and are open to borrowers with lower credit scores. The maximum depends on the lender's guidelines, borrower's down payment and home's location. Allowable loan amounts generally are higher in places where housing is more costly.

The Department of Veterans Affairs itself doesn’t require a minimum credit score. Instead, the minimum comes from the mortgage lenders that offer VA loans. Although the credit score requirements vary, you may find that they use more flexible criteria than a conventional loan does. While conventional loan lenders will also have different credit score requirements, the minimum usually sits around 620. Rocket Mortgage® offers VA loans with a minimum credit score of 580.

They also come without mortgage insurance costs, which limit your buying power. The VA does however charge a funding fee based on the borrower's type of U.S. service, loan amount, type of loan and down payment, among other factors. The fee can be financed into the loan and in some cases can be waived, for additional details visit our VA Loan calculator.

Conventional loans and VA loans are both financial products available to veterans, and each loan comes with its own benefits. Conventional loans typically offer more property options, whereas VA loans afford more down payment and credit flexibility. VA loans, however, don’t require any mortgage insurance.

Suzanne De Vita is the mortgage editor for Bankrate, focusing on mortgage and real estate topics for homebuyers, homeowners, investors and renters. Again, if less than 20% down, must pay for PMI until you reach a loan-to-value ratio of 80%. Additionally, the lack of a down payment may pose some problems.

You’re also likely to have a lower mortgage rate and cheaper monthly payments. VA funding fee and perhaps putting enough money down on a conventional mortgage to forgo mortgage insurance, the choice may be more complex. And, some of the VA loan benefits, such as no minimum credit score and no maximum debt-to-income ratio, are often overstated.

They are issued by independent financial institutions, which are able to offer more favorable terms since the VA guarantees a portion of the funds. Conventional loans that conform to Fannie Mae or Freddie Mac guidelines require a down payment of at least 3 percent for well-qualified borrowers . Department of Veterans Affairs , are available only to U.S. military servicepeople, veterans, some surviving military spouses and others who have served their country in specific ways. It’s also important to note that refinancing an FHA or VA loan can be easier than refinancing a conventional mortgage. Both FHA and VA offer streamlined refinancing, which allows you to bypass some steps in the process, like submitting some financial documentation or waiting on an appraisal.

No comments:

Post a Comment