Table of Content

In fact, this mortgage program is the most popular type of loan, according to the most recent report from Ellie Mae. When comparing VA to conventional loans, it's best to talk to a home loan specialist to compare your options. Even Veterans with significant cash reserves may still find VA loans as the better choice based on rates and lack of PMI.

If you’re thinking about buying a home soon, you might be wondering which type of mortgage is best to pursue. Whether you should go with a convention, FHA or VA loan will depend on a few factors related to your financial situation. Borrowers who are VA-eligible should consider both VA and conventional financing and compare the two.

FHA Vs. Conventional Loans Vs. VA Loan

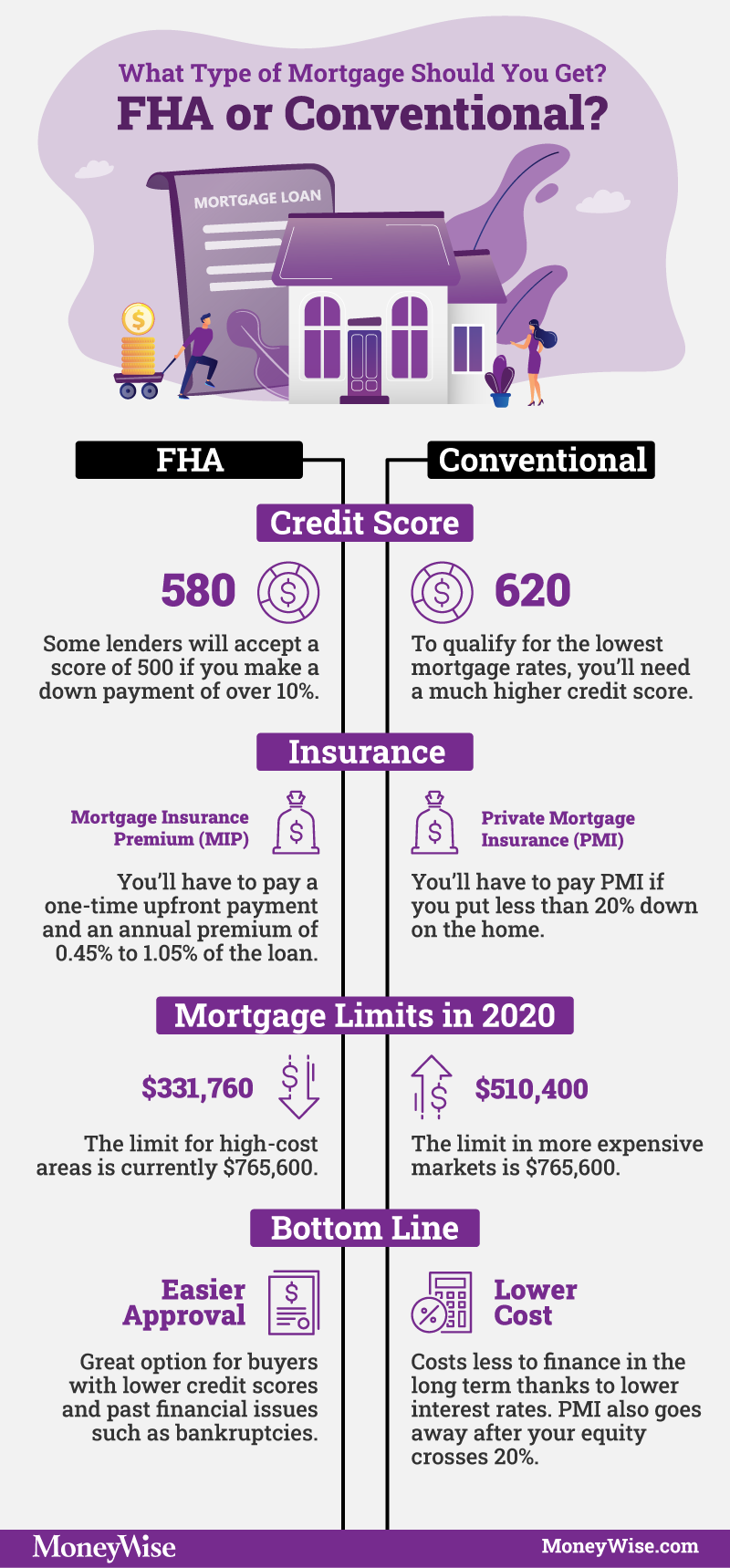

Conversely, conventional loans are available to purchase primary residences, vacation homes, rental properties and other investment property. Conventional loans with less than 20 percent down require private mortgage insurance . Depending on home price, credit score and other factors, PMI can easily run $150 to $200 monthly.

Molly Grace is a staff writer focusing on mortgages, personal finance and homeownership. Upfront MIP is equal to 1.75% of your loan amount and can either be paid at closing or rolled into the cost of the loan. Jay was able to make sure we had everything we needed, kept us informed as information was turned in and how long it would take for our home loan to be processed. VA Home Loan Centers is an approved originator of VA mortgages. Learn more about VA loans and who can be approved for one. We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Down Payment

What you may be presented is not inclusive of all lenders/loan products and not all lenders will be able to make you an offer for a loan. If you do qualify for VA loans, then it is likely that the rates will be one of the benefits of this type of lending. For a 30-year loan, the average rate of a VA loan is 3.02%, whereas interest rates for conventional loans are closer to 3.26%. It doesn’t sound like a lot, but on such a large purchase and over a long period of time, this can make a huge difference.

It can save you money and allow you to get on the property ladder without having to save up a large sum of money for a deposit. Moreover, some buyers may prefer to have immediate equity in their homes. Without a down payment, you will have less equity in your property. As a result, you may be unable to use your home as collateral to secure another loan, like a mezzanine loan. A conventional loan may also offer you a higher loan amount and other perks that the VA restricts on a Veterans home loan. Conventional loans are conforming and can be transferred to a large mortgage buying institution.

Main difference between VA loans and Conventional loans:

Borrowers with a FICO credit score as low as 500 might be eligible for an FHA-insured loan. Your score needs to be 580 or higher to qualify for the lowest down payment. But a funding fee, a one-time charge between around 1.25% and 3.6% of the loan amount, is required. If you have a low credit score and a small down payment, you might want to consider an FHA-insured loan because other loans typically aren't available to those with bad credit. Conventional loans usually accept a maximum of 43% debt-to-income ratio.

This compensation may impact how and where offers are presented to consumers. OpenLoans.com does not make loan offers but instead pairs potential borrowers with lenders and lending partners. We are not a lender, do not make credit decisions, broker loans, or make short-term cash loans. We also do not charge fees to potential borrowers for our services and do not represent or endorse any particular participating lender or lending partner, service, or product. Submitting a request allows us to refer you to third-party lenders and lending partners and does not constitute approval for a loan.

The funding fee can either be paid upfront as a closing cost or rolled into the loan. You can learn more about VA loan eligibility and minimum service requirements at VA.gov. Let’s start with government-backed loans because they have the most flexibility.

Still, VA loans typically offer better deals for buyers (especially first-time buyers) than conventional loans. So it’s worth working with your real estate agent and the seller’s agent to see if you can get the offer accepted as-is. On the other hand, conventional loans are more flexible and can be used to buy almost any property — including a second home or vacation home.

VA loans do not require PMI, saving the borrower thousands over the life of the loan. PMI protects the lender if you default on your loan and typically falls off after you reach 80 percent loan-to-value . The flagship benefit of the VA loan is the VA loan's down payment requirements or lack thereof.

All rate availability will depend upon an individual's credit score and details of the loan transaction. First-time homebuyers may not qualify for a jumbo product. The interest rates quoted here are subject to change at any time and cannot be guaranteed until locked in by your Loan Officer. The VA funding fee ranges from 1.4 to 3.6 percent and is applied to every VA purchase and refinance loan.

They also come without mortgage insurance costs, which limit your buying power. The VA does however charge a funding fee based on the borrower's type of U.S. service, loan amount, type of loan and down payment, among other factors. The fee can be financed into the loan and in some cases can be waived, for additional details visit our VA Loan calculator.

Yet not, in the event the below 20% off, will have to purchase individual financial insurance rates . Which kind of financing you ought to get relies on your personal need and you will activities. However, your rate will also depend on your own financial situation. Working to improve your credit score or saving for a larger down payment can help you snag a better rate.

If you’re eligible, VA loans are an excellent option for home buyers, offering competitive interest rates and requiring no down payment. Conventional loans that conform to Fannie Mae or Freddie Mac guidelines are limited to a maximum loan amount (up to $625,500 for a single family residence) that depends on where the home is located. Some non-conforming conventional loans known as jumbo loans have no loan limit.

No comments:

Post a Comment